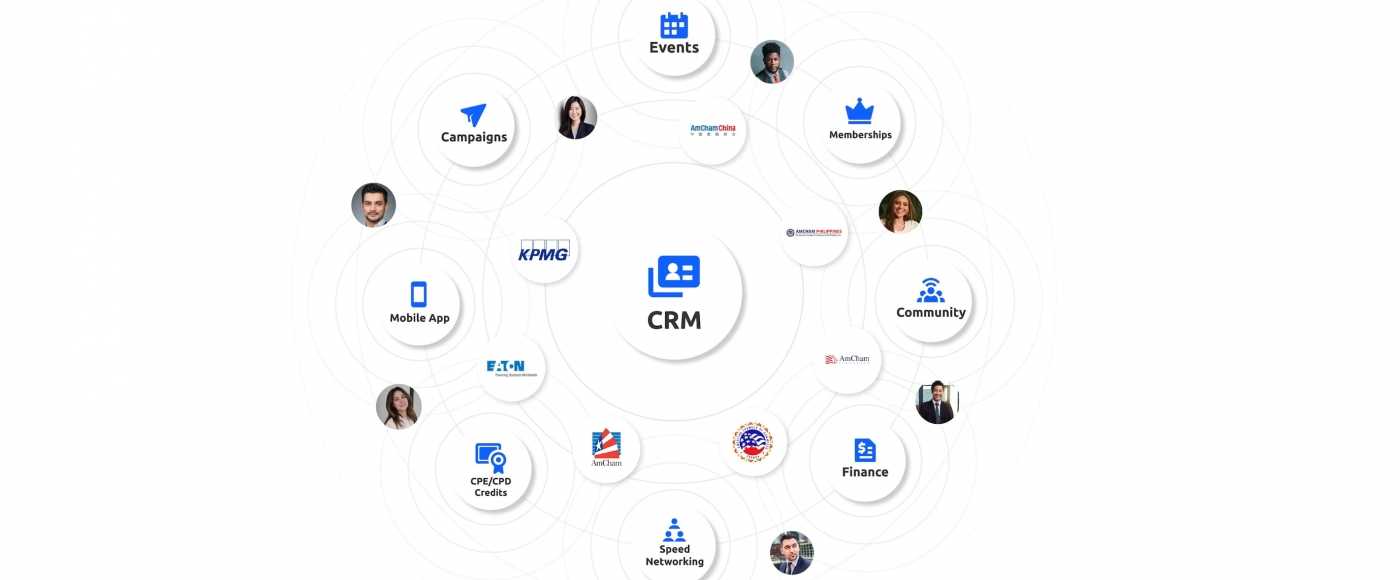

Increase engagement and enable your community to thrive

- About Us

- Board and staff

- test menu 3

- test menu 4

- Committees

- Blog

- Board and staff

- Events & Programming

- Membership

- Resources

- Contact Us

Open Virtual Networking with Breakouts

Open Virtual Networking with Breakouts

Increase engagement and enable your community to thrive