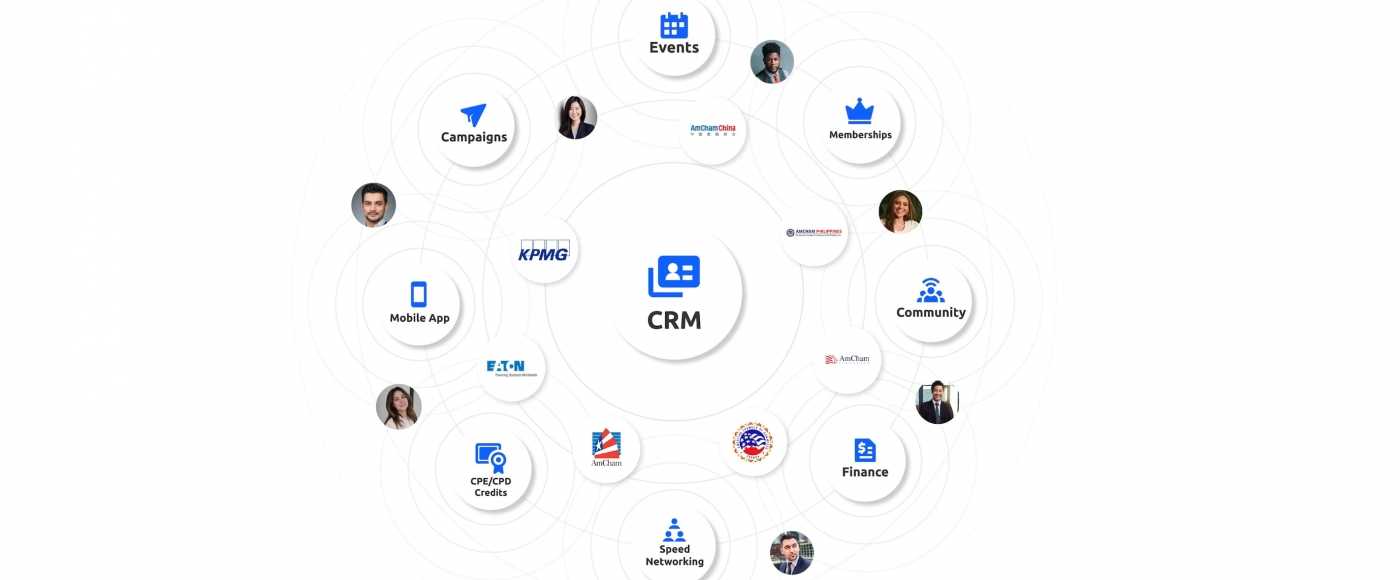

Increase engagement and enable your community to thrive

- About Us

- Board and staff

- test menu 3

- test menu 4

- Committees

- Blog

- Board and staff

- Events & Programming

- Membership

- Resources

- Contact Us

Creating a Marketing Flight Path - Open Virtual Networking with Breakouts

Understand the main elements of business-related finances, such as budgeting, saving, borrowing money and managing debt, understand how to keep cash flow moving and stay connected with customers

Increase engagement and enable your community to thrive